The digital patient acquisition landscape in the United Kingdom and Ireland has reached an inflection point in 2025. The confluence of systemic pressures on public health systems, specifically the National Health Service (NHS) in the UK and the Health Service Executive (HSE) in Ireland, has fundamentally altered patient behavior. The private healthcare sector is no longer merely a luxury alternative but a critical release valve for capacity-constrained public services. Consequently, Pay-Per-Click (PPC) advertising on Google Ads has transitioned from a supplementary marketing channel to the primary engine of patient volume for private clinics, hospitals, and digital health providers.

This comprehensive report, drawing upon over £5.5 million in analyzed annual ad spend and data from thousands of active campaigns 1, provides an exhaustive analysis of the paid search ecosystem. It dissects performance metrics across more than 30 medical specialties, ranging from high-volume primary care to ultra-niche surgical interventions.

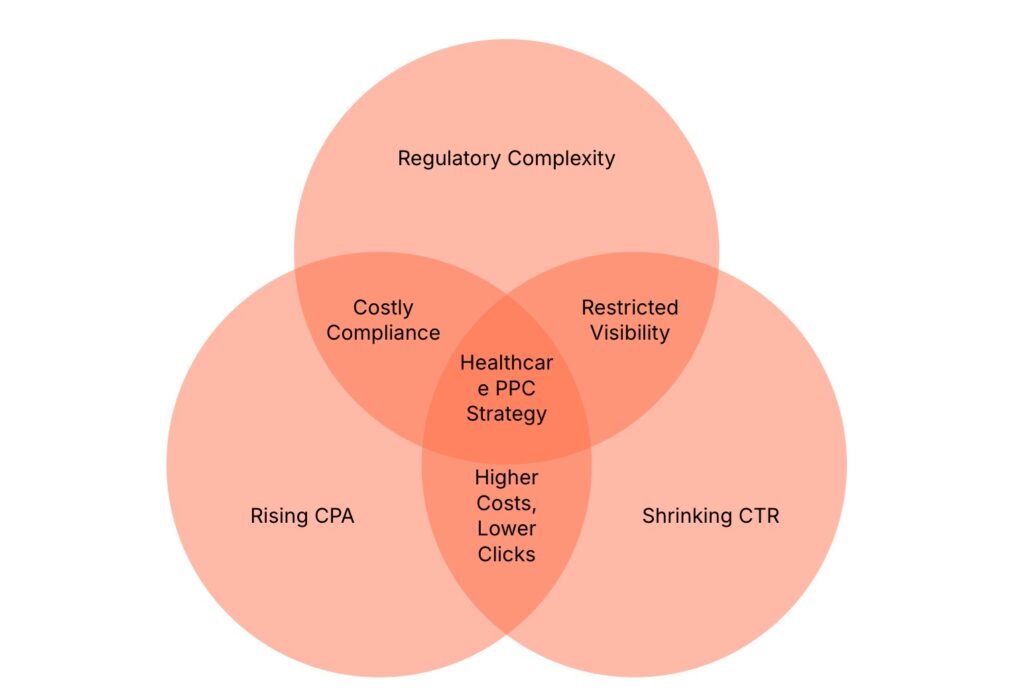

The analysis reveals a market characterized by increasing efficiency demands. While demand is at record highs, so too is competition. The era of “cheap clicks” has concluded. The 2025 paradigm is defined by rising Cost Per Acquisition (CPA) driven by inflation and platform saturation, shrinking Click-Through Rates (CTR) due to the encroachment of AI-generated search features, and a regulatory environment that is increasingly divergent between the UK’s Advertising Standards Authority (ASA) and Ireland’s Health Products Regulatory Authority (HPRA).

Furthermore, the outlook for 2026 suggests a seismic shift in search behavior. The maturation of Google’s Search Generative Experience (SGE) and AI Overviews threatens to cannibalize top-of-funnel informational traffic, forcing advertisers to rethink attribution models and bidding strategies. This report serves as a strategic roadmap for healthcare stakeholders to navigate these complexities, maximize Return on Ad Spend (ROAS), and prepare for the privacy-first, AI-driven future of medical marketing.

1. Macro-Economic and Digital Health Landscape 2025

1.1 The Efficiency Era and the “Self-Pay” Surge

In 2025, the primary driver of private healthcare demand in the UK remains the operational challenges within the NHS. With waiting lists for elective procedures and diagnostics remaining stubbornly high, the “self-pay” market—patients paying for treatment directly from savings or loans rather than through insurance—has solidified. This demographic is distinct from the traditional insured patient; they are price-sensitive, highly research-oriented, and value speed of access above all else.1

Data indicates that patients are increasingly treating healthcare access as a consumer transaction. The search query syntax has shifted from purely informational (“symptoms of hernia”) to transactional and logistical (“private hernia repair cost London,” “same day GP appointment near me”). This shift has intensified the competition on commercial-intent keywords, driving up Cost Per Click (CPC) across the board. However, this price sensitivity also means that conversion rates (CVR) are volatile; patients are clicking multiple ads to compare “all-inclusive” pricing packages before committing, lengthening the attribution window.3

1.2 The Irish Context: Insurance and Inflation

While the UK market is heavily influenced by the self-pay dynamic, the Irish market operates under a different pressure system, heavily dictated by Private Medical Insurance (PMI) penetration. Providers such as Vhi, Laya Healthcare, and Irish Life Health dominate the landscape.4 Marketing in Ireland requires a dual strategy: attracting the self-pay patient while ensuring visibility for insured patients seeking consultant-led care.

The inflation of insurance premiums in 2025—driven by high-cost drugs and increased demand—has made Irish consumers acutely value-conscious.5 Consequently, PPC campaigns in Ireland must explicitly signal insurance coverage (e.g., “Full Vhi Coverage Available”) to maintain high Click-Through Rates (CTR). Furthermore, the HSE’s “Digital for Care” framework 7 is raising patient expectations for digital interfaces. Private clinics in Ireland that fail to offer seamless online booking and digital triage are seeing conversion rates lag significantly behind those that do.

1.3 The Divergence of Regulation

A critical theme for 2025 is the widening regulatory gap between the UK and Ireland. While both jurisdictions prioritize patient safety, the interpretation of advertising laws regarding medical products differs.

- United Kingdom: The Committee of Advertising Practice (CAP) and the ASA enforce strict rules, particularly regarding the advertising of Prescription Only Medicines (POMs) like Botox. However, recent policy updates by Google have allowed for more flexibility in areas like addiction services and erectile dysfunction, provided advertisers meet strict certification requirements.8

- Ireland: The HPRA enforces a more rigid interpretation of EU directives. The advertising of any prescription medicine to the public is strictly prohibited, including indirect references. This makes marketing services like “medical weight loss” or “anti-wrinkle injections” significantly more complex in Ireland, requiring distinct ad copy and landing page strategies compared to the UK.10

2. Comprehensive PPC Benchmarks 2025

The following benchmarks represent the aggregate performance of well-optimized, direct-to-patient healthcare campaigns in the UK and Ireland. It is crucial to distinguish these “medical service” benchmarks from broader “health and wellness” or e-commerce data, which often distort expectations. These figures represent the reality for clinics, hospitals, and private practitioners.

2.1 Cross-Specialty Industry Averages

The 2025 data reveals a tightening market. While patient intent is high, the cost of participation in the Google Ads auction has risen.

| Metric | 2025 Benchmark | Healthy Range | Trend Analysis |

| Click-Through Rate (CTR) | 6.55% | 4.91% – 7.62% | Decrease (-32.5% YoY): The proliferation of AI Overviews (SGE) and “zero-click” searches has reduced the organic and paid CTR for informational queries. Users are getting answers directly on the SERP. |

| Cost Per Click (CPC) | £1.86 | £1.28 – £2.36 | Increase (+10.1% YoY): Inflationary bidding and increased competition from new market entrants (digital health startups, aggregators) have driven up costs. |

| Conversion Rate (CVR) | 4.89% | 2.83% – 6.26% | Decrease (-9.3% YoY): Patients are engaging in more comparison shopping. The “consideration phase” has lengthened as self-pay patients weigh costs against NHS wait times. |

| Cost Per Acquisition (CPA) | £47.91 | £26.32 – £64.39 | Increase (+13.6% YoY): The combined effect of higher CPCs and slightly lower CVRs has pushed the cost of acquiring a new patient enquiry higher. |

Source Data: 1

Strategic Implication: The rising CPA necessitates a focus on Lifetime Value (LTV). Clinics can no longer afford to evaluate campaigns solely on the cost of the initial consultation booking. The ROI calculation must factor in the full value of the surgical procedure, follow-ups, and potential cross-referrals.

2.2 Performance Matrix by Category

The following table segments performance by medical category, highlighting the inverse relationship often seen between urgency/medical necessity and acquisition cost.

| Specialty Category | Avg CTR | Avg CPC | Avg CVR | Target CPA | Market Dynamics |

| Primary Care (GP) | 7.80% | £1.73 | 7.21% | £24.04 | High volume, commoditized. Success depends on location and convenience (“near me”). |

| Surgical (Ortho/Gen) | 6.37% | £1.48 | 4.72% | £31.32 | High ROI. Pain-driven urgency reduces comparison shopping. |

| Women’s Health | 6.60% | £2.26 | 7.57% | £29.79 | Very high intent. Sensitive nature drives quick conversion once trust is established. |

| Men’s Health (Uro) | 7.30% | £1.29 | 6.68% | £29.25 | “Embarrassment factor” drives online booking over phone calls. High efficiency. |

| Mental Health | 6.28% | £1.02 | 4.69% | £21.74 | Low CPC but high noise. Capacity constraints often bottleneck conversion volume. |

| Dermatology | 7.04% | £1.52 | 5.71% | £26.65 | Mix of medical (high convert) and cosmetic (lower convert). |

| Cosmetic Surgery | 5.95% | £1.68 | 3.68% | £45.66 | “Window shopping” behavior is high. Requires strong retargeting (where compliant). |

| Fertility / IVF | 6.78% | £2.63 | 5.76% | £45.72 | Emotional, high-stakes purchase. Long lead times. |

| Diagnostics (MRI/CT) | 5.71% | £1.88 | 3.25% | £57.93 | Highly commoditized. Price is the primary differentiator. |

3. Deep Dive: Specialty-Specific Analysis

This section provides a granular analysis of PPC dynamics for 30+ specific services, integrating keyword strategies, regulatory considerations, and economic benchmarks.

1. Orthopaedics (Hip, Knee, Shoulder)

Orthopaedics remains the gold standard for PPC efficiency in 2025. The patient journey is driven by physical pain and immobility, creating a high level of urgency that overrides prolonged price comparison.

- Keyword Strategy: Specificity is key. Terms like “private hip replacement cost” or “MAKO robotic knee surgery” filter for high-intent users. Generic terms like “knee pain” should be avoided or heavily restricted to exact match to prevent budget wastage on users seeking physiotherapy or home remedies.12

- Ad Copy: Must emphasize speed of access (“Skip the Wait List”) and consultant expertise. The mention of “Robotic Assisted” technology is a growing differentiator that increases CTR among researched patients.

- Economics: With a CPA of ~£31 and procedure values ranging from £10,000 to £15,000, Orthopaedics offers one of the highest ROAS in the sector.

2. General Surgery (Hernia, Gallbladder)

The “self-pay” market for general surgery is thriving due to NHS deprioritization of non-urgent procedures like hernia repair.

- Targeting: Men aged 40+ are the primary demographic for hernia repairs. Ad schedules should be optimized for evenings and weekends when patients discuss options with family.

- Value Proposition: “Walk-in, walk-out” procedures and “all-inclusive pricing” are critical hooks. Patients fear hidden hospital costs; transparency here reduces friction.

- CPA: Targets of £35–£45 are achievable.1

3. Bariatric Surgery

The bariatric market is in transition. The explosion of GLP-1 weight loss injections has cannibalized the lower-BMI segment of this market.

- Pivot: PPC strategies must now focus on patients with higher BMIs or those for whom medication has failed. Keywords like “gastric sleeve vs wegovy” are emerging.

- Cost: Competition is fierce, driving CPAs to £60–£80.

- Compliance: Ads must strictly adhere to responsible weight loss messaging, avoiding “miracle cure” language which violates Google’s health policies.

4. Neurosurgery & Spinal Surgery

This is a low-volume, high-value vertical.

- CPC: High (£5.00+) due to the extreme value of a surgical conversion.

- Tactics: Targeting specific conditions like “spinal stenosis treatment” or “sciatica surgery” is more effective than generic “back pain” terms.

- Trust Signals: Landing pages must heavily feature surgeon credentials and hospital affiliation (e.g., “Consultant at Queen Square”).

5. Ophthalmology (Cataract & Laser Eye Surgery)

- Cataract: An older demographic, often searching on behalf of themselves or by their children. High urgency due to vision loss affecting driving/independence. CPA targets: £30–£50.

- Laser Eye (LASIK/SMILE): A younger, lifestyle-driven demographic. Highly competitive with national chains (Optical Express, etc.) driving up CPCs.

- Benchmarks: The market is seeing a shift toward “lens replacement” (RLE) for the 50+ demographic, which commands a higher price point and warrants a higher CPA (£60+).13

6. ENT (Ear, Nose, Throat)

ENT is an efficiency star, often boasting the lowest CPAs in the medical sector.

- Drivers: The conditions (sinusitis, tonsillitis, ear infections) are acute, annoying, and have a clear “fix.”

- Performance: CTRs are high (~6.00%) and conversion rates lead the pack at >8%.1

- Niche: “Balloon Sinuplasty” and “Endoscopic Sinus Surgery” are high-value keywords with low competition compared to general terms.

7. Cardiology

Private cardiology is a dual market: acute symptomatic patients (palpitations, chest pain) and preventative screeners.

- Benchmarks: CTR 7.43%, CPC £1.63.12

- Strategy: “Private cardiologist near me” is the highest volume term. However, “Calcium Score CT” and “Heart Screening” are growing segments driven by wellness trends.

- Content: Ad copy must be reassuring but urgent. “Same day heart tests” is a powerful value proposition.

8. Gastroenterology

- Volume: High volume for “Endoscopy” and “Colonoscopy” due to bowel cancer screening awareness.

- Keywords: “Private colonoscopy cost” and “IBS specialist.”

- CPA: £35–£50.

- Nuance: Patients are often embarrassed; privacy and discretion in ad copy (“Private & Confidential Clinics”) can improve CTR.15

9. Pain Management

- Regulation: Google has strict policies against “Speculative and Experimental Medical Treatment” and the promotion of opioid painkillers.16 Ads must focus on management and relief through interventional procedures (injections, blocks).

- CPA: £50–£80.18

- Strategy: Focus on condition-specific keywords (“Sciatica relief,” “Facet joint injection”) rather than generic “pain clinic.”

10. Oncology

- Sensitivity: Marketing oncology requires extreme sensitivity. Patients are often frightened and overwhelmed.

- Keywords: “Private chemotherapy,” “Cancer second opinion,” “Private radiotherapy.”

- Ad Copy: Focus on speed of diagnosis and access to advanced drugs not available on the NHS (e.g., Immunotherapy).

- Ethical Note: Avoid fear-mongering. Focus on “rapid access” and “expert care”.19

3.2 Women’s Health and Fertility

11. Gynaecology

- Performance: Consistently strong performance with a CPA of ~£30.1

- Services: Menopause clinics are booming in 2025. “HRT prescription private” and “Endometriosis specialist” are top-performing keywords.

- Trust: Female-led clinics often see higher CTRs when this is highlighted in ad copy (“Female Gynaecologist Available”).

12. Fertility / IVF

- Economics: High CPA (£45+) reflects the crowded market and long decision cycle.1

- Strategy: “Price per cycle” transparency is a major click driver. However, the patient journey is emotional. Retargeting (using non-sensitive audience segments) and email nurturing are essential to convert the initial interest.

- Market: The UK market is projected to reach £1.1bn by 2030, driving aggressive bidding from large clinic networks.21

13. Obstetrics / Maternity

- Location: Highly London-centric for private delivery (The Portland, Lindo Wing). CPCs in London can exceed £5.00.

- Keywords: “Private C-section cost,” “Private maternity package.”

- Policy: strict adherence to policies regarding “guarantees” of birth outcomes.

3.3 Men’s Health

14. Urology

- Efficiency: One of the most efficient verticals with a CPA often under £20.1

- Drivers: Prostate health, kidney stones, and general men’s health checks.

- Behavior: Men often prefer the anonymity of digital booking over discussing symptoms via phone receptionists.

15. Erectile Dysfunction (ED)

- Policy Change: Recent updates allow certified advertisers to bid on prescription terms (Sildenafil/Tadalafil) in the UK.8

- Competition: Clinics compete with online pharmacies (Hims, Numan). Clinics must differentiate by emphasizing the medical investigation aspect (Doppler ultrasound, hormonal bloods) rather than just pill dispensation.

- CPA: High (£50+) due to saturation.

16. Vasectomy

- Commodity: Highly price-sensitive. Ads compete on “No Scalpel” technique and “All-inclusive price.”

- CPA: £30–£40.22

- Timing: Search volume often spikes in January and prior to summer holidays.

17. Azospermia & Male Infertility

- Niche: Extremely low volume but high intent.

- Keywords: “Surgical sperm retrieval,” “Micro-TESE cost,” “Azoospermia treatment.”

- Strategy: Because volume is low, “Broad Match” keywords (with smart bidding) are acceptable here to capture long-tail variations, provided robust negative keyword lists (excluding generic “sperm count test”) are in place.23

18. Testosterone Replacement Therapy (TRT)

- Regulation: TRT is a heavily scrutinized area. Ads must focus on “Hormone Deficiency” or “Low T Symptoms” rather than promising muscle growth or lifestyle enhancements, which can flag for “speculative therapy” policies.

- CPA: £40–£60.

3.4 Diagnostics and Imaging

19. Ultrasound (Private)

- Dichotomy: The market is split between “Baby Scanning” (4D/Gender) and “Medical Ultrasound” (MSK/Abdominal).

- Baby Scan: Retail-like behavior, low CPC (£1.00), high volume, location-driven.25

- Medical: Needs strict negative keywords to avoid “gender reveal” traffic. Focus on “radiologist report included” to build value.

20. MRI & CT Scans

- Price War: This sector is racing to the bottom on price. “MRI from £199” headlines dominate.

- CPA: High (£57+) relative to the cost because users shop around extensively.1

- Ad Assets: Sitelinks to “Open MRI” or “Upright MRI” are powerful differentiators for claustrophobic patients.

21. DEXA Scans

- Dual Market:

- Medical: Osteoporosis screening (older women). Keywords: “Bone density scan.”

- Fitness: Body composition (biohackers/athletes). Keywords: “Body fat scan,” “Visceral fat test”.26

- Strategy: These require two separate campaigns with distinct landing pages. Mixing the messaging confuses the user and lowers Conversion Rate.

3.5 Primary Care and Chronic Management

22. General Practice (Private GP)

- Booming: The inability to access NHS GPs has exploded this vertical.

- Performance: High CTR (7.80%) and CVR (7.21%).1

- Winning Hook: “Same Day Appointment” is the single most effective headline.

- Strategy: Hyper-local targeting (3-5 mile radius) is essential. Users will not travel far for a routine GP visit.

23. Paediatrics

- Parental Anxiety: Parents searching for “private paediatrician” usually have a sick child and are frustrated with NHS delays. Urgency is extremely high.

- Keywords: “Private child doctor,” “Paediatric allergy testing.”

- Trust: Ad copy must highlight consultant experience (“Consultant Paediatrician,” not just “Doctor”).1

24. Hyperbaric Oxygen Therapy (HBOT)

- Awareness: This is an awareness-phase market. Many patients don’t know HBOT is a solution for their issue (Long COVID, wound healing, sports recovery).

- Tactics: Use Display and Video ads for education. In Search, target the condition (“Diabetic foot ulcer treatment,” “Long covid fatigue relief”) rather than just “HBOT” to capture patients seeking solutions.27

25. Occupational Therapy

- B2B/B2C Mix: Traffic is a mix of individuals and case managers/solicitors.

- Keywords: “Sensory integration therapy,” “Hand therapy private.”

- Strategy: Use “Audience Observation” in Google Ads to bid higher for users in legal or insurance market segments.28

26. Speech & Language Therapy

- Demographic: Parents of children with developmental delays, or stroke survivors.

- Keywords: “Private speech therapist for autism,” “Adult speech therapy.”

- CPA: £30–£50.29

27. Nutrition & Dietetics

- Competition: High competition from apps (Noom, etc.) and non-clinical nutritionists.

- Differentiation: Clinical dietitians must emphasize “HCPC Registered” and “Medical Dietitian” to justify fees over unregulated nutritionists.30

- Niches: IBS (FODMAP), Diabetes, and Eating Disorders are key clinical niches.

28. Home Care / Elderly Care

- Stakeholder: The searcher is usually the adult child, not the patient.

- Keywords: “Live in care cost,” “Dementia care at home.”

- CPA: High (£100+) due to the immense lifetime value of a long-term care contract.31

3.6 Aesthetics and Cosmetic Surgery

29. Cosmetic Surgery (Plastic)

- Cost: High CPCs (£3–£5+) and high CPA (£75–£150).32

- Keywords: “Rhinoplasty London” (£16.90 CPC), “Breast Augmentation UK.”

- Lead Quality: A major issue. “Window shoppers” with no budget are common.

- Mitigation: Use “Price Extensions” in ads to show starting prices (e.g., “From £6,000”). This deters unqualified clicks.

30. MedSpa (Botox/Fillers)

- Regulatory Minefield: As POMs, Botox cannot be advertised to the public in the UK or Ireland.

- Workaround: Ads must target “Anti-wrinkle consultations” or “Skin rejuvenation” services. Using the brand name “Botox” in ad text is a policy violation and will result in disapproval.

- CPL: £20–£40, but requires high volume.34

31. Hair Transplant

- Global Competition: UK clinics compete directly with Turkey (medical tourism).

- Value Prop: UK ads must emphasize safety, regulation (CQC), and aftercare (“UK Surgeons,” “Lifetime Aftercare”). Competing on price alone is a losing battle against Turkish clinics offering packages at £2,500.35

32. Medical Weight Loss (Wegovy/Mounjaro)

- Explosive Growth: Huge search volume surge in 2025.

- Restriction: Ad text cannot name the drugs (Wegovy, Ozempic) in the UK/Ireland due to POM status.37

- Tactics: Advertise “Medical Weight Loss Clinics” or “Doctor-led Weight Management.” Landing pages must focus on the consultation and holistic care, not just the “skinny jab.”

3.7 Dental and Allied Health

33. Dental Implants

- The “Whale”: The most lucrative dental PPC vertical.

- CPC: £5–£15 in cities.39

- CPA: £80–£120.40

- Ad Copy: “Financing” and “Permanent Solutions” are key triggers. “All-on-4” is a high-value niche keyword.

34. Invisalign (Orthodontics)

- Saturation: Extremely competitive. Price wars are common.

- Strategy: “Open Days” with “Free Scans” are the most effective hook to get patients into the funnel.41

- CPA: £35–£100.

35. Physiotherapy

- Hyper-Local: “Near me” searches dominate.

- Mobile First: Users are often in pain or immobile. Mobile bid adjustments should be +20%.42

- CPA: £15–£25.

36. Chiropody / Podiatry

- Bifurcated: “Routine nail care” (low value) vs. “Nail Surgery” (high value).

- Tactics: Separate campaigns to ensure you aren’t paying £2 CPC for a £30 corn removal treatment. Focus budget on “Ingrown toenail surgery”.43

37. Chiropractic & Osteopathy

- Keywords: “Back pain adjustment,” “Chiropractor for sciatica.”

- Ad Copy: Focus on immediate relief. “Walk-ins welcome” works well.

- ROI: High retention rate (recurring visits) justifies a higher initial CPA.

38. Audiology

- Product-Driven: Hearing aids have high margins.

- Hook: “Earwax removal” is a high-volume, low-CPC hook. While the service itself is low value, it brings patients into the clinic for screening, converting a percentage to hearing aid customers.44

3.8 Mental Health and Addiction

39. Mental Health (Psychiatry/Psychology)

- Demand: Surging demand for “Adult ADHD assessment” and “Autism diagnosis.”

- CPA: £21.74.1

- Challenge: Clinic capacity. Many clinics turn off ads because they cannot handle the volume. Waitlist management is key.

40. Addiction / Rehab

- Expense: The most expensive vertical in healthcare. CPCs can exceed £50–£100 for “drug rehab London”.45

- Certification: Advertisers must hold LegitScript certification (or local equivalent) to run ads on Google.46

- CPA: Often £1,000+, but with admission values of £10k–£20k, the economics still work for residential facilities.

4. The Irish Market: 2025 Specifics

The Irish market is not simply a smaller version of the UK market; it has distinct structural drivers.

4.1 Insurance Dominance

Unlike the UK’s growing pay-as-you-go market, Irish consumers rely heavily on reimbursement.

- Ad Copy: Ads should explicitly mention “Covered by Vhi/Laya/Irish Life” to increase CTR. A user with insurance is far more likely to click an ad that confirms coverage upfront.4

- Landing Pages: Must detail “Procedure Codes” so patients can check their specific policy coverage.

4.2 Dublin vs. Regional Targeting

- Dublin: CPCs are comparable to London (£3–£5 for competitive terms).

- Regional: Cork, Galway, Limerick see significantly lower CPCs (£1–£2) but lower search volume.

- Strategy: Regional campaigns can be highly efficient if they target “Consultant clinics” visiting local hospitals (outreach clinics).47

4.3 Digital Health Expectations

The HSE’s “Digital for Care” framework 7 is setting a new standard. Patients now expect digital interactions. Private clinics in Ireland without seamless online booking are seeing conversion rates drop by up to 20% compared to those that offer it.

4.4 Regulatory Tightrope (HPRA)

The HPRA is stricter than the UK’s ASA.

- Prescription Meds: Absolute ban on DTC advertising. No “Botox,” no “Wegovy.”

- Indirect Claims: Even indirect claims like “The Skinny Jab” can be flagged.

- Comparison: Comparative advertising is effectively non-existent due to strict interpretation of “misleading” claims.11

5. 2026 Outlook: The Future of Search

As we look toward 2026, the fundamental mechanics of Search Engine Marketing (SEM) are shifting.

5.1 The “Zero-Click” Threat (AI Overviews)

By 2026, it is estimated that Google’s AI Overviews (SGE) will satisfy 20-30% of informational healthcare queries without a click.48

- Implication: Top-of-funnel traffic (e.g., “What are the symptoms of a hernia?”) will evaporate from clinic websites.

- Strategic Pivot: Budget must shift decisively to Bottom-of-Funnel (BoF) transactional keywords (e.g., “Hernia surgeon London reviews”).

- New Asset Class: Images and structured data on clinic websites are now ad assets. Google uses them to construct its AI overview. Ensure schema markup is flawless to appear in these AI snapshots.

5.2 Privacy Sandbox and Signal Loss

With the depreciation of third-party cookies, tracking the full patient journey is harder.

- Solution: Clinics must implement Google Enhanced Conversions. This involves hashing first-party data (email/phone) captured at the point of lead generation and sending it back to Google to match against signed-in users. This restores attribution lost by cookie blocking.49

- Server-Side Tracking: This will become the standard for accurate reporting in a GDPR/privacy-first environment.

5.3 Automated Bidding Maturity

By 2026, manual bidding will be obsolete. “Value-Based Bidding” (VBB) will be the norm. Clinics will need to feed offline data (e.g., “Patient Attended Appointment”) back into Google Ads so the algorithm optimizes for revenue, not just leads.

6. Conclusion and Recommendations

The 2025 healthcare PPC landscape in the UK and Ireland is defined by a flight to quality. The “easy wins” of low-competition keywords are gone. Success now requires a sophisticated blend of algorithmic bidding, strict regulatory compliance, and a deep understanding of the patient’s financial and emotional journey.

Strategic Recommendations:

- Structure for Intent: Blend your granular Single Keyword Ad Groups (SKAGs) with an “Hagakure” structures that consolidate data for Google’s AI, grouped by intent themes.

- Compliance is Creative: Use regulatory constraints as a creative challenge. In Ireland, focus on the outcome and the consultation rather than the restricted drug.

- Feed the Algorithm: Implement offline conversion tracking. Tell Google which leads actually became patients.

- Prepare for Zero-Click: Assume informational traffic will drop. Strengthen your brand and transactional keyword presence to capture the user after the AI has answered their initial question.

For clinics and practitioners, the message is clear: Do not chase clicks; chase patient value. Align your PPC strategy with operational capacity, focus on high-margin procedures, and prepare your data infrastructure for the AI-driven future of 2026.

Appendix: Quick Reference CPA Targets by Vertical (UK)

| Vertical | Low End CPA | High End CPA | Notes |

| Primary Care (GP) | £20 | £25 | Volume dependent |

| Physiotherapy | £15 | £25 | Hyper-local |

| Mental Health | £20 | £30 | Supply constrained |

| Dermatology | £25 | £35 | Mix of medical/cosmetic |

| Orthopaedics | £30 | £40 | High ROI |

| Fertility | £45 | £60 | Long lead time |

| Dental Implants | £80 | £120 | High competition |

| Rehab/Addiction | £500 | £1,000+ | Very high LTV |

| Cosmetic Surgery | £75 | £150 | High “window shopping” |

| Hearing Aids | £35 | £60 | Product sales focus |

Works cited

- Integrated urgent care: key performance indicators 2025/26 – NHS England, accessed on December 1, 2025, https://www.england.nhs.uk/long-read/integrated-urgent-care-key-performance-indicators-2025-26/

- HealthCare Digital Marketing Benchmarks 2025 | Promodo.com, accessed on December 1, 2025, https://www.promodo.com/blog/healthcare-digital-marketing-benchmarks-2024

- Health Insurance in Ireland, accessed on December 1, 2025, https://www.hia.ie/sites/default/files/2025-04/hia-market-report-2024.pdf

- Irish Life Health to increase price plans for third time within one year – The Journal, accessed on December 1, 2025, https://www.thejournal.ie/irish-life-health-price-increase-6550433-Nov2024/

- Rise in health insurance costs start on Wednesday – Breaking News, accessed on December 1, 2025, https://www.breakingnews.ie/ireland/rise-in-health-insurance-costs-start-on-wednesday-1813343.html

- Healthcare Policy – Tuesday, 25 Mar 2025 – Oireachtas, accessed on December 1, 2025, https://www.oireachtas.ie/en/debates/question/2025-03-25/867/

- Sexual Health & Wellness Policy Expanding Ad Options – PPC News Feed, accessed on December 1, 2025, https://ppcnewsfeed.com/ppc-news/2024-10/sexual-health-wellness-policy-expanding-ad-options/

- Google expands telemedicine ads to UK and Singapore markets – PPC Land, accessed on December 1, 2025, https://ppc.land/google-expands-telemedicine-ads-to-uk-and-singapore-markets/

- Regulating advertising of medicines – HPRA, accessed on December 1, 2025, https://www.hpra.ie/regulation/human-medicine/marketing-authorisation-holders/post-licensing/market-compliance-and-surveillance-of-medicines/advertising-human-medicines-in-ireland

- IPHA SELF-CARE ADVERTISING CODE VERSION 6.1 – Irish Pharmaceutical Healthcare Association, accessed on December 1, 2025, https://www.ipha.ie/wp-content/uploads/2025/03/IPHA-Self-Care-Advertising-Code-Version-6.1-effective-01Jul22pg-final.pdf

- How Does Laser Eye Surgery Work in 2025/26? – EuroEyes London, accessed on December 1, 2025, https://euroeyes.co.uk/how-does-laser-eye-surgery-work-in-2025-26/

- Laser Vision Correction Market Size & Forecast, 2025-2032 – Coherent Market Insights, accessed on December 1, 2025, https://www.coherentmarketinsights.com/market-insight/laser-vision-correction-market-3996

- Gastroenterology PPC Management – Cardinal Digital Marketing, accessed on December 1, 2025, https://www.cardinaldigitalmarketing.com/healthcare-specialties/gastroenterology-agency/ppc-management-services/

- Update to Healthcare and Medicines Policy (October 2025) – Google Help, accessed on December 1, 2025, https://support.google.com/adspolicy/answer/16551459?hl=en

- Healthcare and medicines – Advertising Policies Help – Google Help, accessed on December 1, 2025, https://support.google.com/adspolicy/answer/176031?hl=en

- UK Pain Management Devices Market Size & Outlook, 2030 – Grand View Research, accessed on December 1, 2025, https://www.grandviewresearch.com/horizon/outlook/pain-management-devices-market/uk

- Oncology Marketing | Cancer Care and Hematology Advertising – Healthcare Success, accessed on December 1, 2025, https://healthcaresuccess.com/medical/oncology

- Google Ads for Oncology Clinics – Clinic Marketing Agency, accessed on December 1, 2025, https://clinicmarketing.ai/google-ads-for-oncology-clinics/

- Fertility Sector Outlook for 2025: Trends, Innovations, and Strategic Insights in the UK, accessed on December 1, 2025, https://topfertilityclinicsnearme.com/ertility-sector-outlook-for-2025/

- Google Ads Benchmarks 2025: Competitive Data & Insights for Every Industry | WordStream, accessed on December 1, 2025, https://www.wordstream.com/blog/2025-google-ads-benchmarks

- Private Andrology & Male Infertility Care Services I HCA UK, accessed on December 1, 2025, https://www.hcahealthcare.co.uk/services/departments/fertility-and-reproductive-medicine/fertility-treatments/andrology-and-male-fertility

- Private Treatment Fees – North Tees and Hartlepool NHS Foundation Trust, accessed on December 1, 2025, https://www.nth.nhs.uk/services/assisted-reproduction-unit/private-treatment-fees/

- Ultrasound Keyword Research Blueprint 2025 — Win High‑Intent Traffic, accessed on December 1, 2025, https://ultrasoundtrainers.com/blogs/ultrasound-keyword-research-blueprint-2025-win-high%E2%80%91intent-traffic/

- Private DEXA Scan – Body Fat Measurement – BodyScan, accessed on December 1, 2025, https://bodyscanuk.com/services/dexa-scan

- Hyperbaric Oxygen Therapy [HBOT] Market Size, 2025-2032 – Fortune Business Insights, accessed on December 1, 2025, https://www.fortunebusinessinsights.com/industry-reports/hyperbaric-oxygen-therapy-market-101103

- Work with us – RCOT, accessed on December 1, 2025, https://www.rcot.co.uk/support-the-profession/work-with-us

- Google Ads For Therapists And Group Practices – Therapy Flow, accessed on December 1, 2025, https://mytherapyflow.com/google-ads-for-therapists-and-group-practices/

- Find a dietitian – BDA – British Dietetic Association, accessed on December 1, 2025, https://www.bda.uk.com/find-a-dietitian.html?industry=private-practice

- Average Google Ads Cost per Click by Industry | 2025 Report – Focus Digital, accessed on December 1, 2025, https://focus-digital.co/average-google-ads-cost-per-click-by-industry/

- The Big Shifts In Cosmetic Surgery Marketing Trends 2025 – Sagapixel, accessed on December 1, 2025, https://sagapixel.com/seo/cosmetic-surgery-marketing-trends/

- Cosmetic Surgeon PPC Initiatives: CPC Costs – Wired Media, accessed on December 1, 2025, https://www.wiredmedia.co.uk/2025/03/10/cosmetic-surgeon-ppc-initiatives-cpc-costs/

- Medical Spa Statistics Insights Backed by Spa Market Size – Buyergain, accessed on December 1, 2025, https://buyergain.com/industries/medical-spa-statistics/

- How Much Does a Hair Transplant Cost in 2025? – Hair Growth Centre, accessed on December 1, 2025, https://hairgrowthcentre.com/blogs/how-much-does-a-hair-transplant-cost-in-2025

- UK Hair Transplant Cost 2025: Average Price & Cost Per Graft, accessed on December 1, 2025, https://wimpoleclinic.com/blog/hair-transplant-cost-uk-analysis/

- UK regulators take action against nine advertisers of medicated weight-loss treatments, accessed on December 1, 2025, https://marketinglaw.osborneclarke.com/advertising-regulation/uk-regulators-take-action-against-nine-advertisers-of-medicated-weight-loss-treatments/

- ASA issues warning to weight-loss drug advertisers, accessed on December 1, 2025, https://www.asa.org.uk/news/asa-issues-warning-to-weight-loss-drug-advertisers.html

- Private Healthcare CPC Costs in PPC Advertising – Wired Media, accessed on December 1, 2025, https://www.wiredmedia.co.uk/2025/03/10/private-healthcare-cpc-costs-in-ppc-advertising/

- PPC for Dentists UK | Boost High-Value Patient Leads in 2025, accessed on December 1, 2025, https://www.dominatedental.com/ppc-for-dentists/

- How Dental Practices Can Use Google Ads to Attract More Private Patients – Dentree, accessed on December 1, 2025, https://dentree.co.uk/google-ads-for-dental-practices-the-complete-strategic-guide/

- Healthcare PPC in 2025: A Practical Guide for Google Ads – UpMedico, accessed on December 1, 2025, https://upmedico.com/healthcare-ppc/

- Marketing for Podiatrists: Everything You Need to Know – CC Digital, accessed on December 1, 2025, https://www.ccdigital.co.uk/blog/marketing-for-podiatrists

- 534% Revenue Increase for Regain Hearing (Marketing Case Study) – Exposure Ninja, accessed on December 1, 2025, https://exposureninja.com/our-work/regain-hearing/

- How Much Does PPC Cost for Drug Rehab Centers? – Behavioral Health Partners, accessed on December 1, 2025, https://behavioralhealth.partners/diy-rehab-videos/ppc-cost-for-drug-rehab-centers/

- The Shocking Cost of Google Ads for Rehab Centers (Are You Overpaying?) – YouTube, accessed on December 1, 2025, https://www.youtube.com/watch?v=2VgGgdKT06Y

- Google Ads for Doctors in Dublin – UpMedico, accessed on December 1, 2025, https://upmedico.com/google-ads-for-doctors-in-dublin/

- A Strategic Shift in Search: What Google’s AI Overviews Mean for Healthcare Brands, accessed on December 1, 2025, https://www.revhealth.com/our-perspective/a-strategic-shift-in-search-what-googles-ai-overviews-mean-for-healthcare-brands

- Cookies, Privacy, and Precision: What Health Systems Need to Know – Healthgrades, accessed on December 1, 2025, https://b2b.healthgrades.com/insights/blog/what-health-systems-should-know-about-cookies-and-privacy/